ventura property tax due date

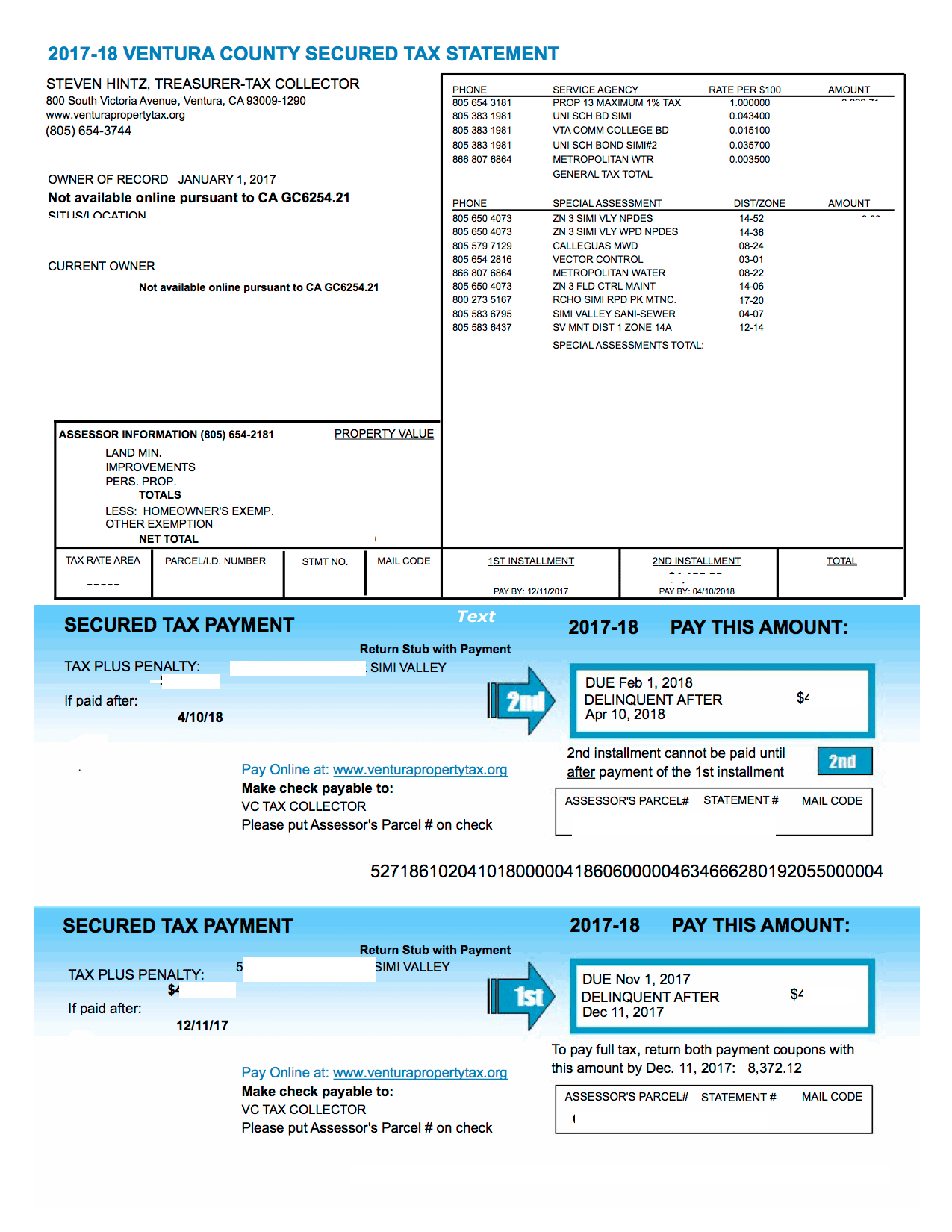

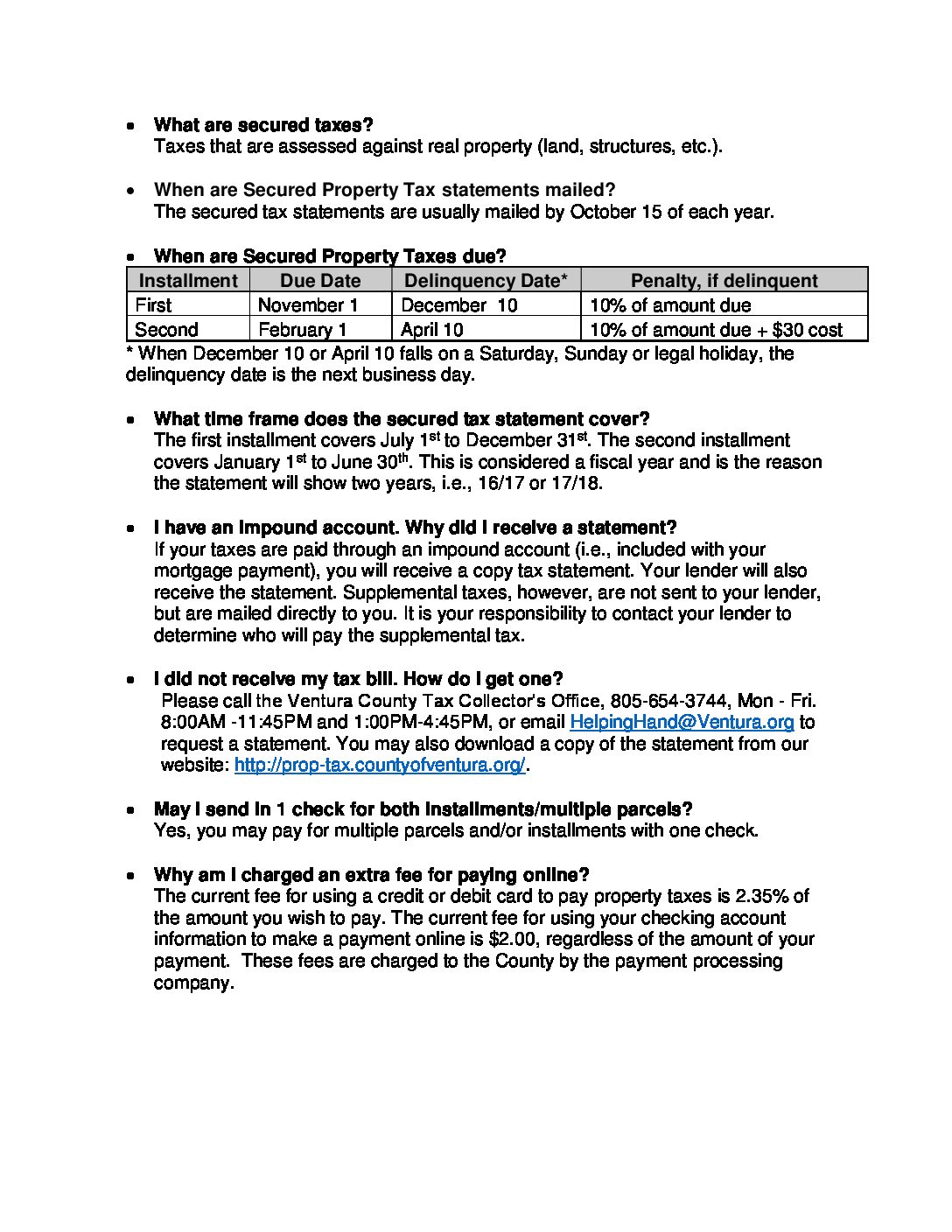

1st Installment is due November 1st delinquent after December 10th. Installment Due Date Delinquency Date Penalty if delinquent First November 1 December 10 10 of amount due Second February 1 April 10 10 of amount due 30 cost When December 10.

Portside Ventura Harbor In Ventura Greystar

The SECOND INSTALLMENT of 2014-2015 taxes are due and payable on February 2 2015 and will become delinquent if not paid by 500 pm.

. Property tax due dates the fiscal year for property taxes runs from july 1 of a given year to june 30 of the following year and property taxes are due in 2 even installments. Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after. The Second Installment of Ventura County 2020-21 Secured Property Taxes was due February 1 2021.

With the help of this rundown youll acquire a helpful sense of real property taxes in Ventura and what you should be aware of when your payment is due. DUE DATES - Ventura County. With that who pays property taxes at closing while buying a house in Ventura County.

Property taxes not paid on or before December 10 2020 will become delinquent and property. Learn all about Ventura County property tax due date with Oak Tree Law today. Secured Tax bills for the new fiscal year.

2nd Installment is due. On April 10 2015 thereafter a 10 penalty and. 29 2021 800 AM.

10 2021 500 PM. If you are contemplating moving there. As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID ONLINE.

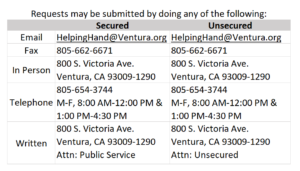

Secured Property Taxes in Ventura County are paid in two installments. Pay Your Taxes - Ventura County. Ventura County collects on average 059 of a propertys assessed.

The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. And March 28 2022 800. The first is due November 1.

Ventura County 2020-21 Secured Property Taxes are due November 1 2020. Ventura County 2020-21 Secured Property Taxes are due November 1 2020. Treasurer-Tax Collector - Ventura County.

O Ventura County Hall of Administ ration parking lot 800 South Vict oria Avenue Ventura CA 93009 Available Nov. It becomes delinquent if not paid by December 10. TAX COLLECTOR FAQS - Ventura County.

For more information contact the Los Angeles attorneys at OakTree Law today. Taxes become a lien on all taxable property at 1201 am. Taxes paid after April 12 2021 will be assessed a late payment penalty fee of.

Secured Taxes - Ventura County. First day to file affidavit and claim for exemption with assessor but on or before 500 pm. The second installment is due February 1 and becomes delinquent if not paid by April 10.

Customarily whole-year real estate taxes are paid upfront at the beginning of the tax year.

Rgcshows Ventura Rgcshows One Of The West Coast S Largest Of It S Kind Market Place

Tax Collector Faq S Ventura County

Where Can I Pay My Ventura County Property Taxes During Covid

Covid 19 Coronavirus Emergency Information And Resources City Of Simi Valley Ca

Bootleggers Rumrunners And Blind Piggers Prohibition In Ventura County Museum Of Ventura County

Ventura Council Approves Players Casino S Next Move

Technology Infrastructure Strategic Plan Ppt Download

The New Ventura Water Rate Increase Will Effectively Cost You 43 More Venturans For Responsible And Efficient Government

Job Opportunities Welcome To The City Of Ventura

Faqs Final 08 22 17 3 Ventura County

/https://s3.amazonaws.com/lmbucket0/media/business_map/boost-mobile-ca-ventura-1073-nventura-ave-93001.f2b9fbc2ddae.png)

Boost Mobile 1073 N Ventura Ave Ventura Ca

Land Conservation Act Lca Program

1560 San Nicholas St Ventura Ca 93001 Mls V1 7798 Redfin

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Free Tax Preparation Eitc United Way

Tax Collector Faq S Ventura County